|

Ways to Give to the Educational Foundation

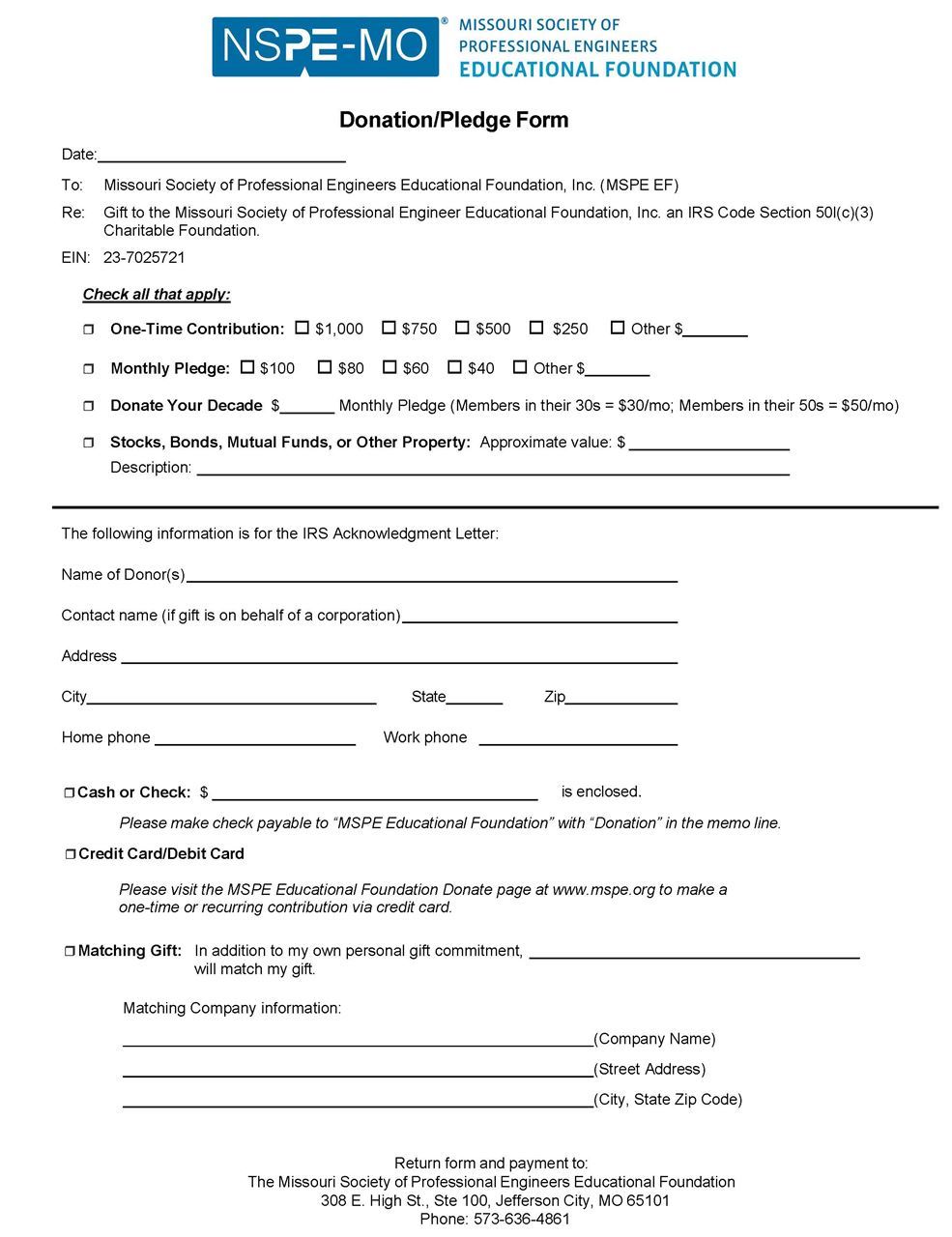

There are several ways to donate to support the mission and activities of the MSPE Educational Foundation. Please see the donation form at the bottom of this page if you are not donating by credit or debit card..

Contribute Today with Cash or Check

Checks can be made payable to: MSPE Educational Foundation. If you itemize tax deductions, you may be able to deduct a gift of cash up to 50% of your income.

Contribute Today with your Debit/Credit Card

EF uses PayPal to process single or recurring donations made with your debit or credit cards.

Establish a Memorial

A memorial can be created in the memory of a loved one that dedicated part of their life to the engineering industry or STEM activities. Memorial gifts would acknowledge the memory of the loved one.

Give Retirement

401K or IRA accounts can also be used as charitable gifts to the MSPE Educational Foundation.

Make a Tax-Free Gift from your IRA. You may be eligible to make a tax-free gift to the MSPE Educational Foundation from your individual retirement account (IRA). Many donors have taken advantage of this opportunity in the past to transform lives through technology. The IRA charitable rollover law was officially reinstated in 2015.

Congress passed the Charitable IRA Rollover provision permanently. This enabled individual retirement account (IRA) owners in the United States over the age of 70½ to transfer to qualifying charities – including the MSPE Educational Foundation – up to $100,000 per year from their IRA, which counts toward one’s required minimum distribution for the year while at the same time avoiding being taxed. What a way to support the MSPE Educational Foundation AND maximize the impact of your IRA!

At the MSPE Educational Foundation, we know that philanthropy is personal. We also know that, for many, a strategic financial approach to philanthropy can maximize impact while also supporting your personal financial goals. If you’ve been waiting to make your IRS transfer this year, we encourage you to act now and request the distribution in order to qualify for the tax year.

HOW IT WORKS

- If you are 70½ or older, you can give up to $100,000 directly from your IRA to charities like the MSPE Educational Foundation. The transfer generates neither taxable income nor a tax deduction, so you still benefit even if you do not itemize your tax deductions.

- If you have not taken your required minimum distribution for the year, your IRA charitable rollover gift can satisfy all or part of that requirement.

- The transfer may be made in addition to any other charitable giving you have planned.

- The gift needs to be made by December 31, if you want your gift to qualify for taxes.

If you are interested in this unique opportunity to promote the goals of the MSPE Educational Foundation and support the MSPE professional community, or if you have any questions, please contact foundation@mspe.org or call us at 573-636-4861.

Contact your financial advisor to ensure your contribution is properly scheduled for your tax preparations.

MSPE Educational Foundation

308 E. High Street

Suite 100

Jefferson City, MO 65101

foundation@mspe.org

Click HERE for a pdf of the Donation/Pledge form below.

|